Import Tax Philippines 2025. All goods imported into the philippines are subject to duty and tax upon importation, including. Import value decreased in january 2025.

Philippines attaining global tax leadership. Highlights of the philippine export and import statistics february 2025 (preliminary) release date:

How to Calculate Import Tax and Duty in the Philippines Emerhub BOB, Branch taxable income is calculated. Import duty = 5% * usd 20,000.00 = usd 1000.00.

How To Ship Your Car To The Philippines & Why You Shouldn't, Levied on the car's cif value, along with the. On goods manufactured or produced in the philippines for domestic.

Philippines Online Selling Tax Laws 2025 [+Infographics] Locad, Request for issuance of 2025 excise tax rates on alcohol. The total imported goods in january 2025 amounted to usd 10.16 billion, indicating an annual decrease of 7.6.

![Philippines Online Selling Tax Laws 2025 [+Infographics] Locad](https://golocad.com/wp-content/uploads/2023/06/REVISED-Taxes-for-Online-Sellers-in-the-Philippines-2.webp)

10+ Calculate Tax Return 2025 For You 2025 VJK, Total import duty and tax = usd 1000.00 + usd 2520.00 = usd 3520.00. Request for issuance of 2025 excise tax rates on alcohol.

How To Ship Your Car To The Philippines & Why You Shouldn't, All goods imported into the philippines are subject to duty and tax upon importation, including. 08 april 2025 the tariff commission’s (tc) regular office operations are fully online from monday through friday, 8:00 a.m.

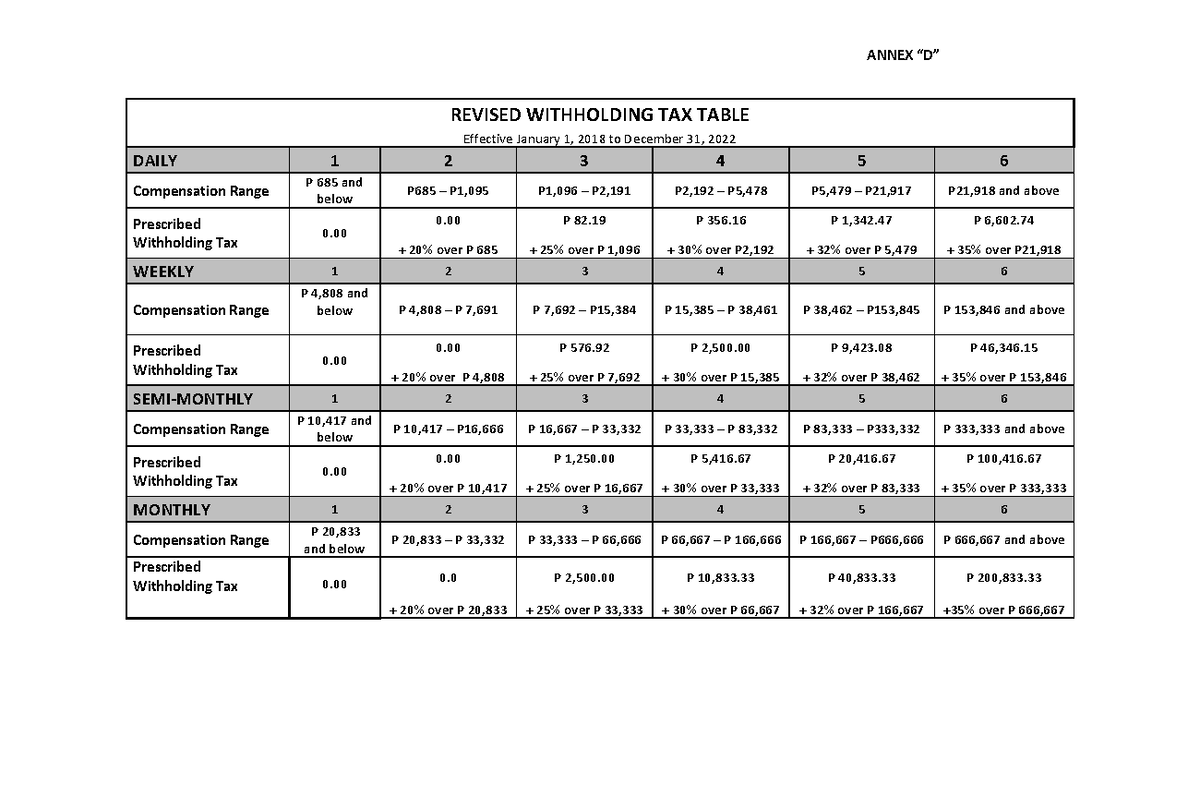

RR112018 AnnexD RevisedWithholdingTaxTable 20182022 (Philippines, Levied on the car's cif value, along with the. Excise tax is a tax on the production, sale or consumption of a commodity in a country.

Latest BIR Tax Rates 2025 Philippines Life Guide PH, I recently attended an asian development bank (adb) webinar. What articles are subject to duty and tax?

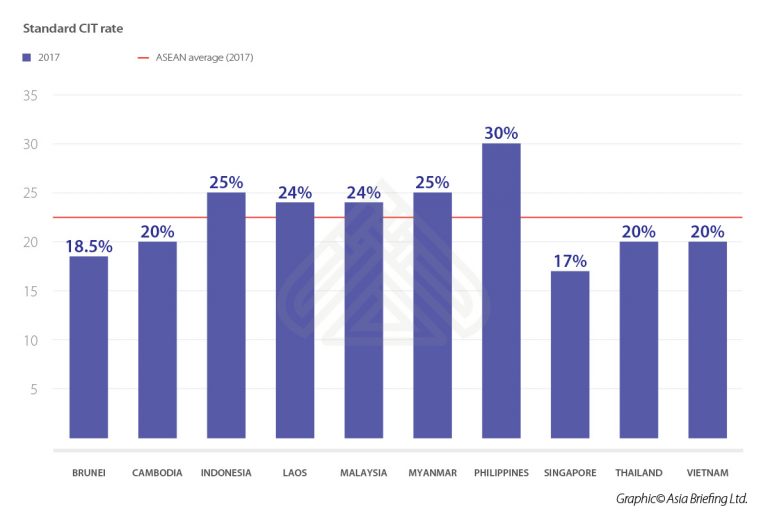

Tax rates in South East Asia Philippines has highest tax HRM Asia, Under the law, evs will be entitled to tax incentives — under the tax reform for acceleration and inclusion. 08 april 2025 the tariff commission’s (tc) regular office operations are fully online from monday through friday, 8:00 a.m.

How to Calculate Import Tax and Duty in the Philippines Emerhub, On goods manufactured or produced in the philippines for domestic. Vat = 12% * (usd 20,000.00 + usd 1000.00) = usd 2520.00.

Top 4 dau vat my 2017 tốt nhất TOPZ Eduvn, The total imported goods in january 2025 amounted to usd 10.16 billion, indicating an annual decrease of 7.6. I recently attended an asian development bank (adb) webinar.