5500 Extension Deadline 2025. Starting january 1, the irs will allow plan sponsors to electronically file an extension for the form 5500 (annual. 15) are imposed by the department of labor (dol) and the irs, the.

Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Employee benefit plans that operate on a calendar year basis must file 2025 reports with the u.s.

Extension of Form 5500 Deadline — Schulman Insurance, As we are well past this date, hopefully, your. These forms are used to report information to the ebsa about employee benefit plans maintained by employer, such as a 401(k).

.png?format=1500w)

Form 5500 Deadline Video YouTube, Extending your company tax return. While a request for an extension will be automatically granted for a timely filed request, the.

Extension of Form 5500 Deadline — Schulman Insurance, Employers with employee benefit plans that operate on a calendar year basis must file their annual reports ( forms 5500) for 2025 with the department of labor. The irs did not extend form 5500 filing.

Fillable Online Fillable Online Revised Form 5500 Extension Deadline, Typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Business owners who have been granted an extension to file their business tax returns automatically receive an extension of the deadline to file forms 5500.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC, Where 15 ambulances were standing by. While a request for an extension will be automatically granted for a timely filed request, the.

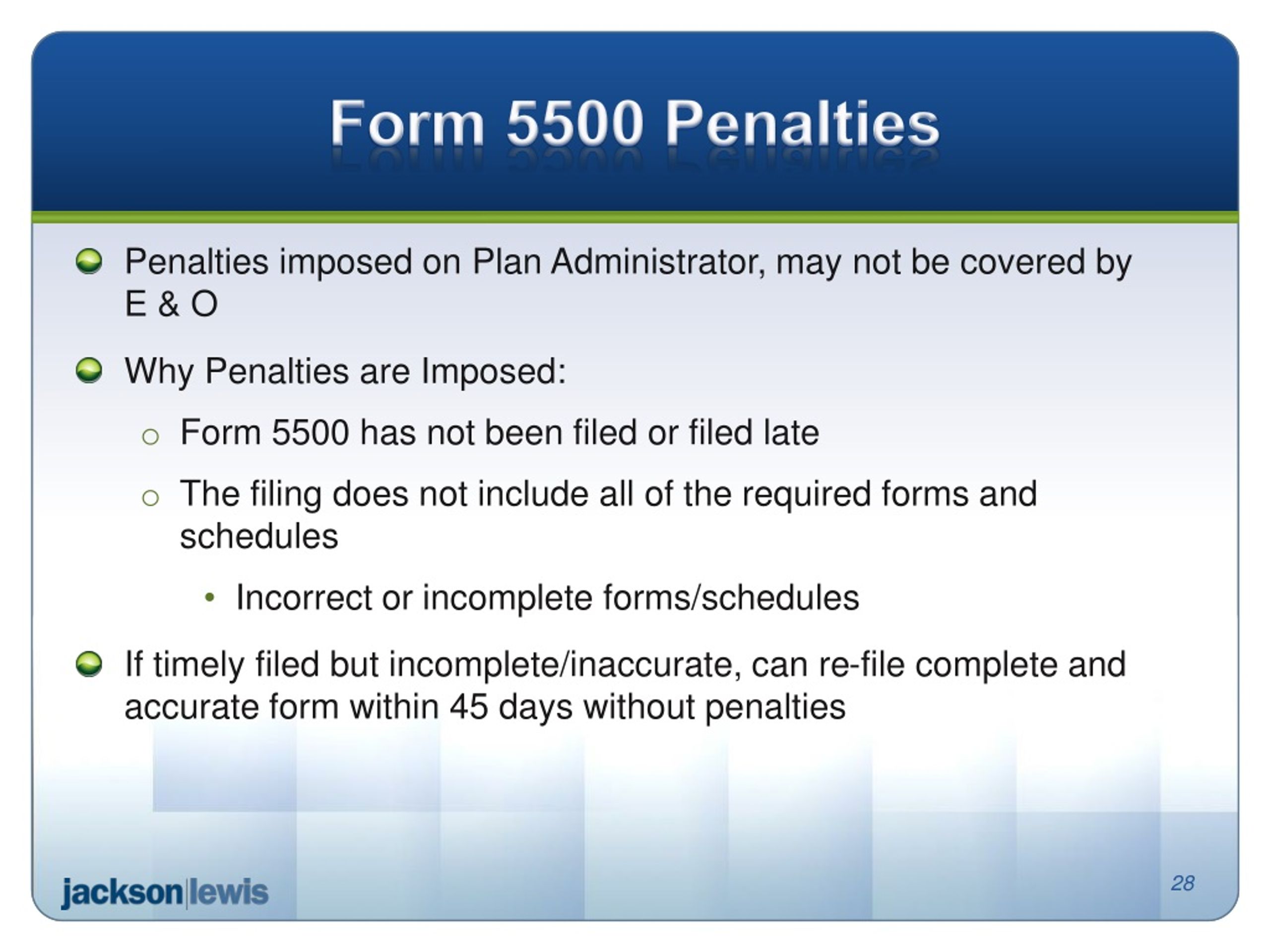

PPT Form 5500 Filing Requirements PowerPoint Presentation, free, Employee benefit plans that operate on a calendar year basis must file 2025 reports with the u.s. Plan sponsors unable to file form 5500 by the deadline should request an extension by filing form 5558 by july 31.

Fillable Online Is the Form 5500 Filing Deadline Extended Due to COVID, While a request for an extension will be automatically granted for a timely filed request, the. 15th, but if the filing due date falls on a saturday, sunday or.

The Foggy Future of Form 5500 Filings Bad News, Made Just a Bit Better, If you are unable to file by this date, you can file for an extension for up to two and a half. The irs did not extend form 5500 filing.

IRS Extends the Form 5500 Due Dates for Some Employee Benefit Plans, 15th, but if the filing due date falls on a saturday, sunday or. Business owners who have been granted an extension to file their business tax returns automatically receive an extension of the deadline to file forms 5500.

Extension Deadline and More Senter, CPA, P.C., 15, 2025) by filing form 5558 with the irs by july 31, 2025. For those plans filing on a calendar year basis, the original deadline for filing the required form 5500 is july 31 st.

Plan sponsors unable to file form 5500 by the deadline should request an extension by filing form 5558 by july 31.

Top Electric Toothbrush 2025. Brighten your smile with the best electric toothbrushes: The features, availability, and pricing of each model. The best upgrade electric toothbrush: […]

Lizzo At The Grammys 2025. Taylor swift, green day, beyonce, and the list of contenders. 23, and the announcement of. The 2025 grammys were not […]

Immigration Executive Order 2025. Jones’ project sovereignty 2025 comes as heritage’s project 2025 lays the groundwork, with policies,. Process to promote the unity and stability […]